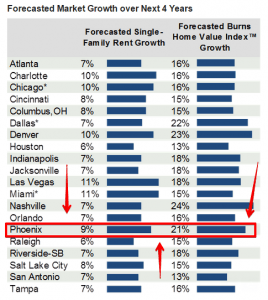

According to John Burns Real Estate Consulting, you can sum Phoenix rents and real estate prices over the next 4 years in a word: UP. We'll make it easy and outline Phoenix in red and point some arrows at it: What does this mean? Burns believes single family rents in Phoenix will be up 9% in the next 4 years. (by the way, if you are concerned that your rents are not keeping pace with the market, we can do a free rental analysis for you here so you sleep better). On top of that, they believe Phoenix area home prices will appreciate 21%, one of the strongest numbers in major cities compared. What is causing this? Theories abound, but you can take a look at the following graphic from Burns for some clues:

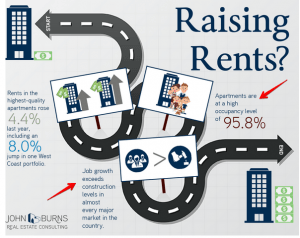

Point #1: Job growth exceeds construction levels in almost every market in the country. In plain talk, people will follow the jobs into major cities. And when they do? There is not enough housing built yet. Fewer homes, more people = rising rents (since those people who have jobs have some money in their pocket and if one person can't afford a rent increase, another can). Seems like simple economics to us. Point #2: Apartments are at very high occupancy levels (nearly 96%). Its almost never the case that apartments are 100% full due to peoples changing circumstances, but 96% is pretty darn close to 'full'. So those people chasing jobs to the major cities, are finding no existing apartments to live in, and new construction is not moving fast enough to make up for it, so naturally when supply outstrips demand, prices/rents rise. Its a good time to own Phoenix rental real estate.